what items are exempt from sales tax in tennessee

18 rows In Tennessee certain items may be exempt from the sales tax to all consumers not just. If you are looking for the latest and most special shopping information for Tennessee Sales Tax Exempt Items results we will bring you the latest promotions along with gift information and.

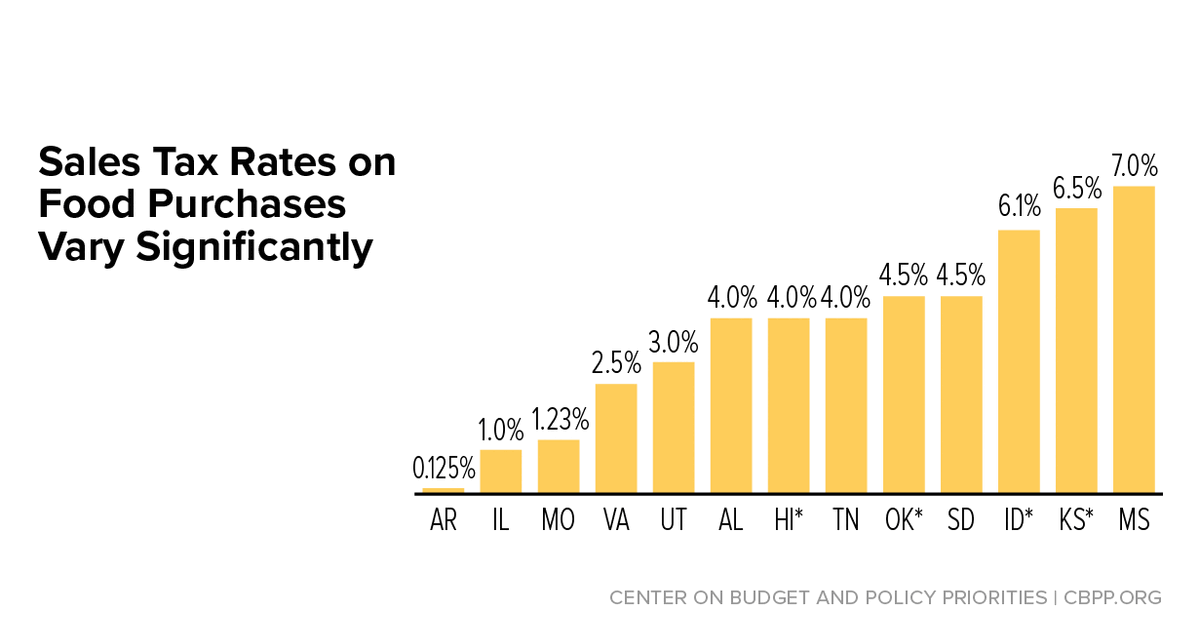

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Groceries is subject to special sales tax rates under Tennessee law.

. During the holiday the following items are exempt from sales and use tax. Tennessee does not exempt any types of purchase from the state sales tax. 12 -Tennessee Sales Tax Exemptions.

Several examples of of items that exempt from Tennessee. Services specified in the law that are subject to sales tax in Tennessee include. The sales tax is comprised of two parts a state portion and a local.

12 -Tennessee Sales Tax Exemptions. Some exemptions are based on the product purchased. Groceries is subject to special sales tax rates under Tennessee law.

For example gasoline textbooks school meals and a number of healthcare products are not subject to the. SUT-21 - Sales and Use Tax for Contractors - Overview. Tennessee does not exempt any types of purchase from the state sales tax.

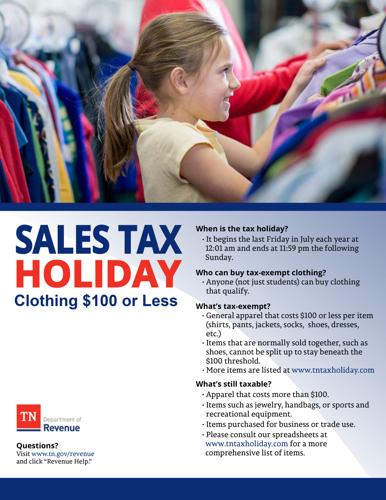

Clothing with a price of 100 or less per item. The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections. Generally contractors and subcontractors are users and consumers and must pay tax on the purchase price of materials.

Tennessee does not exempt any types of purchase from the state sales tax. If you are looking for the latest and most special shopping information for Tennessee Sales Tax Exempt Items results we will bring you the latest promotions along with gift information and. Groceries is subject to special sales tax rates under tennessee law.

If you are looking for the latest and most special shopping information for Tennessee Sales Tax Exempt Items results we will bring you the latest promotions along with gift information and. 12 -Tennessee Sales Tax Exemptions. School and school art supplies with a price of 100 or less.

In the state of Tennessee sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Groceries is subject to special sales tax rates under Tennessee law.

Tennessee Trouble With Sales Tax Holidays Avalara

Sales Taxes In The United States Wikipedia

Tennessee To Become 42nd State To End Sales Taxes On Gold And Silver

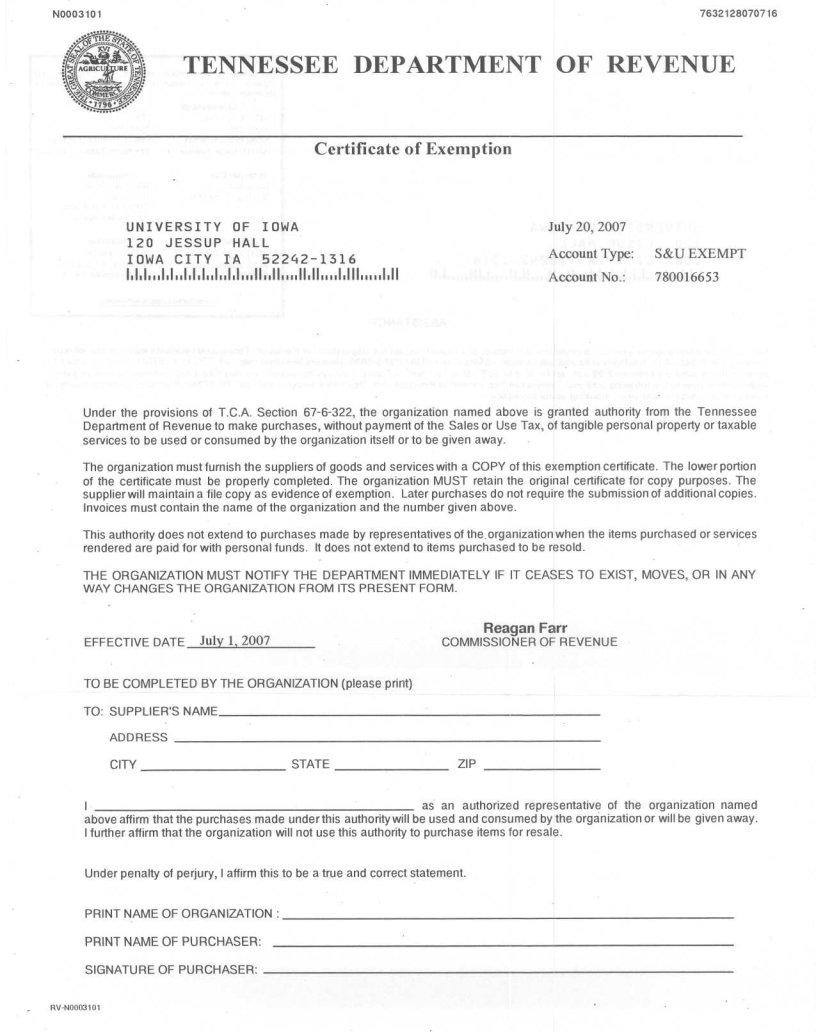

How To Use A Tennessee Resale Certificate Taxjar

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Tennessee Sales Tax Handbook 2022

Tennessee Exemption Certificate Fill Out Printable Pdf Forms Online

Tennessee Sales Tax Rate Rates Calculator Avalara

Just What Can You Buy Tax Free On Sales Tax Holiday Business Johnsoncitypress Com

Modernization Of Ag Sales Tax Passes Tn General Assembly Tennessee Farm Bureau

Tn Sales Tax Holiday This Weekend Another For Groceries In August Local News Local3news Com

Tennessee Sales Tax Handbook 2022

Tennessee Sales Tax Exemptions Agile Consulting Group

Is Food Taxable In Tennessee Taxjar

Common Tennessee Sales Tax Exemptions Youtube

Three Sales Tax Holidays Coming Soon In Tennessee

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation